As the world is in shock about Donald Trump’s erratic but not unexpected decision to withdraw the United States from the Paris climate accord, reactions range from the denial of the momentous consequences of this decision through dismay to desperate calls for retaliation. It is clear, this decision unmistakably indicates that the United States is no longer deserving of the global leadership role that it has long held but now sees as a burden. As other countries and parties way their options, they should not overlook a potentially powerful strategy to reduce the US carbon footprint: shift away from the dollar.

This option is grounded in seemingly unrelated phenomena:

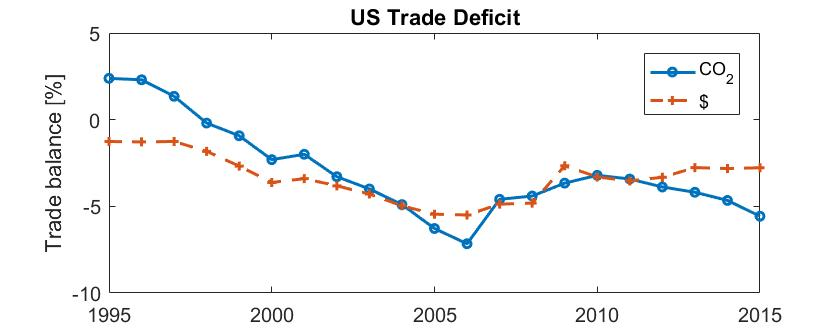

First, in addition to driving oversized vehicles and having grossly inefficient buildings, a significant part of the carbon footprint of the United States is related its import of goods from other countries. The US has been running substantial trade deficits with the rest of the world for well over two decades. In 2016, the deficit in the trade of goods and services was $ 500 billion, or 3% of GDP. Measured in carbon, the US trade deficit amounted to 300 million tons of CO2 or 6% of its domestic emissions. Nixing this trade deficit would be a useful contribution to global emission reductions, able to offset a substantial portion of the damage done by Trump.

Second, countries can run a persistent trade deficit and current account deficit only when somebody loans them money or invests in them. The US has been spending more than it earns for an extensive period of time, binging on consumption. Such an imbalance is normally not possible. It can only be sustained because

Third,US dollar serves as the global reserve currency. Central banks of all countries need to hold dollars to stabilize their own currencies. As emerging economies develop, more dollars are needed, both to conduct international trade, as bilateral contracts, say between Saudi Arabia and South Korea, are denominated in dollars, and to grow foreign reserves of central banks. Other countries obtain the dollars they need by selling products to America. These sales are the root cause of the trade imbalances.

The reserve currency system has become outmoded and a threat to economic stability, especially given erratic US politics. It has become a bad deal for everybody. For those of us who invest in the US, we get much lower returns on our investment than US companies accrue on their overseas investments. For US workers, a dollar overvalued compared to the economic vitality of the economy and subsequent competition from cheap imports has meant job losses and salary cuts. Only US lawyers and banks benefit.

So, what can other countries do? First, get your central banks to diversify their portfolio of reserves to include a broader basket of currencies. Such a step is necessary in the long run, so better do it sooner!

Second, start developing contracts denominated in other currencies or basket of currencies such as ‘special drawing rights.’ This step is also likely to reduce the exposure of these contracts to currency fluctuations.

Third, get your own assets, including your pension fund, to shift away from investments in the United States, especially those in low-yield government bonds. You deserve better!

These steps should relieve the US of the ‘exorbitant privilege’ of issuing the reserve currency of the world, thereby removing the reason for its trade imbalance. If we are collectively successful in our efforts, US consumers will reduce their emissions by as much as current emissions of global aviation. A worthwhile goal, no doubt. We will also have helped Trump achieve one of his election promises. That we can stomach.

Geographical origin of CO2 emissions, their flow from producers to consumers, and the resulting carbon footprints of countries, in the year 2007

I am professor of industrial ecology at the Norwegian University of Science and Technology.

June 02, 2017